EcoYield Energy

Data-Driven Tokenomics Design for Solar Asset Tokenization

Executive Summary

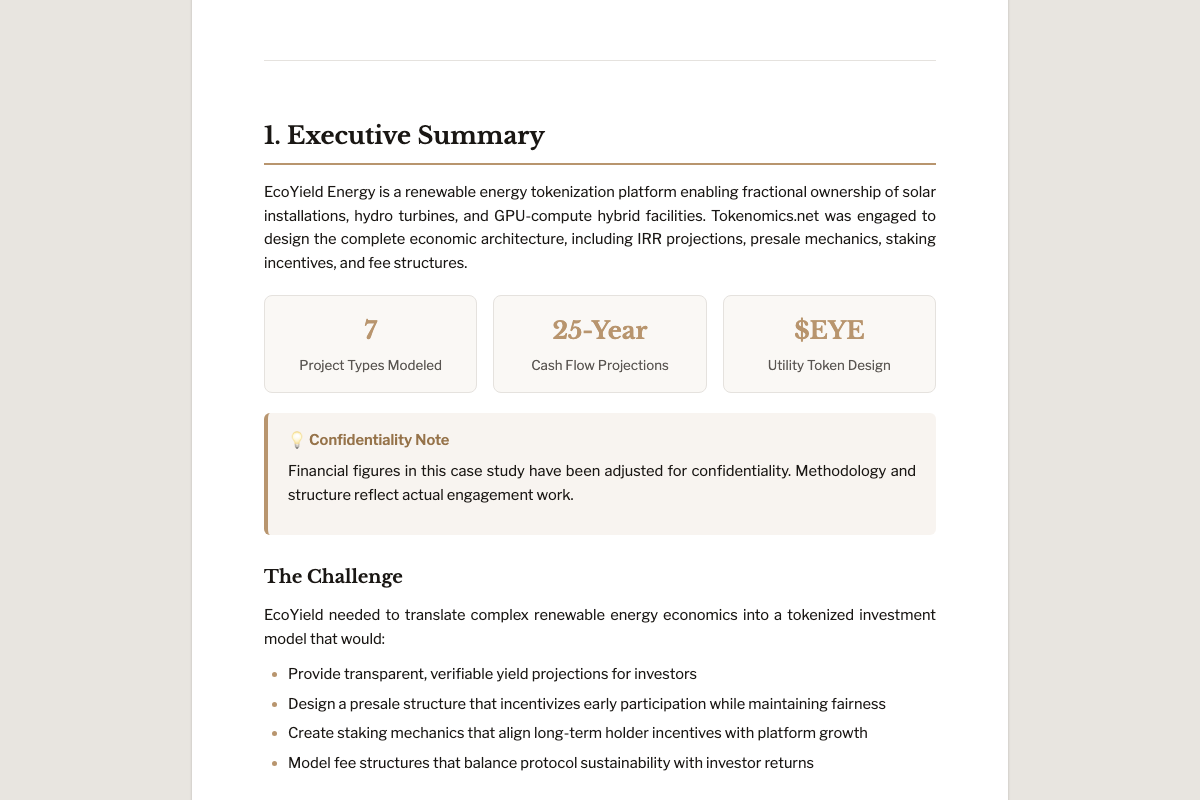

EcoYield Energy is a renewable energy tokenization platform enabling fractional ownership of solar installations, hydro turbines, and GPU-compute hybrid facilities. Tokenomics.net was engaged to design the complete economic architecture, including IRR projections, presale mechanics, staking incentives, and fee structures.

We applied our data-driven methodology: building comprehensive financial models from first principles, running scenario analyses, and stress-testing assumptions across market conditions. Every design decision was backed by quantitative analysis.

Financial figures in this case study have been adjusted for confidentiality. Methodology and structure reflect actual engagement work.

“From the very start, Tony brought a level of clarity, intelligence, and deep expertise that made a huge difference in shaping our tokenomics and wider ecosystem design. His ability to balance creative design thinking with sharp economic modelling made him a standout contributor.”

— Jordan Myers, Co-Founder, EcoYield Energy | CEO, JLM Energy

The Challenge

EcoYield needed to translate complex renewable energy economics into a tokenized investment model that would:

- Provide transparent, verifiable yield projections for investors

- Design a presale structure that incentivizes early participation while maintaining fairness

- Create staking mechanics that align long-term holder incentives with platform growth

- Model fee structures that balance protocol sustainability with investor returns

Scope of Work

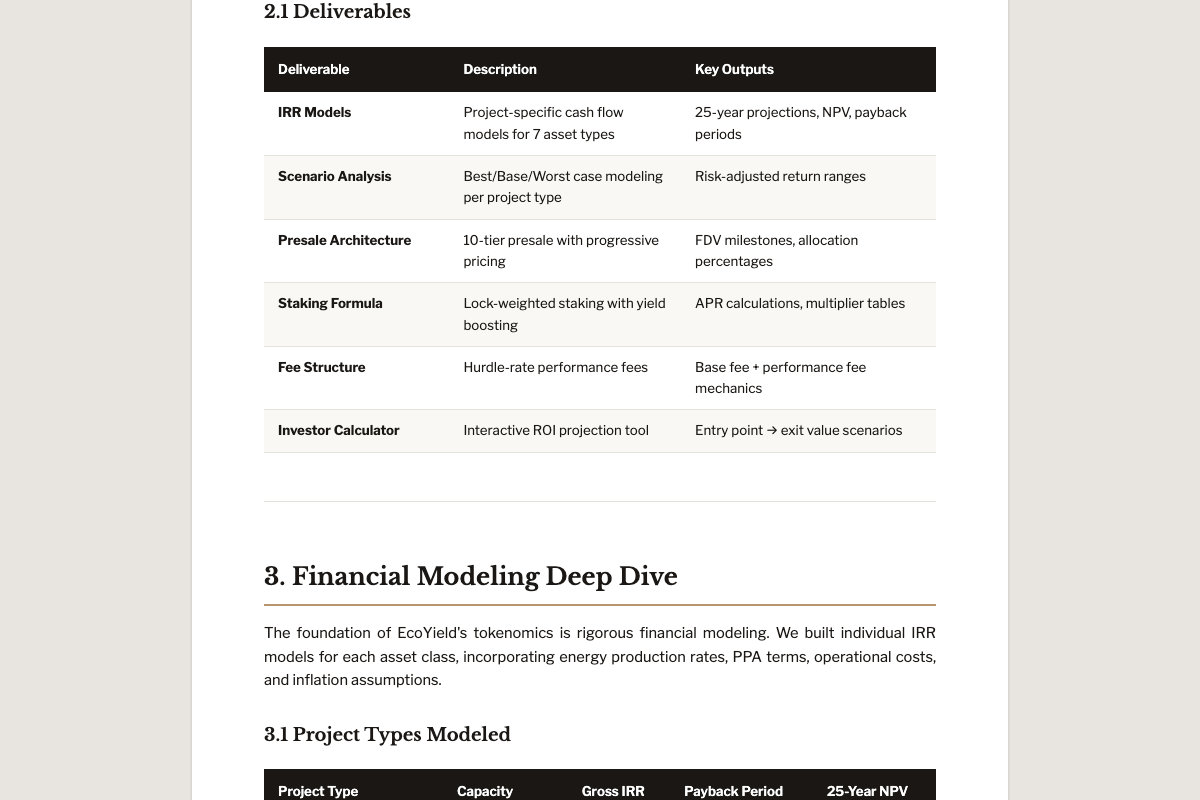

Engagement deliverables overview

Deliverables

| Deliverable | Description | Key Outputs |

|---|---|---|

| IRR Models | Project-specific cash flow models for 7 asset types | 25-year projections, NPV, payback periods |

| Scenario Analysis | Best/Base/Worst case modeling per project type | Risk-adjusted return ranges |

| Supply-Side Spreadsheet | Token allocation, vesting schedules, and emission modeling | Distribution tables, unlock timelines, circulating supply projections |

| Staking Formula | Lock-weighted staking with yield boosting | APR calculations, multiplier tables |

| Fee Structure | Protocol fee design across investor + operator flows | Revenue projections, sustainability math |

What We Delivered: A complete tokenomics system backed by real cash-flow modeling, scenario stress tests, and explicit formulas that investors can audit.

Financial Modeling & IRR Projections

We built first-principles IRR models for each asset type, including operating costs, revenue assumptions, and capital expenditure schedules. These models served as the foundation for token utility design and investor yield projections.

Model Inputs

| Input | Description | Why It Mattered |

|---|---|---|

| Energy production | kWh generation by project type + degradation curves | Direct driver of revenue and yield |

| Tariff rates | Expected price per kWh and contract assumptions | Determines cash flow sensitivity |

| CapEx + OpEx | Build cost, maintenance, insurance, overhead | Controls payback period and downside scenarios |

| Token supply & emissions | Distribution schedules and unlock mechanics | Affects investor dilution and price stability |

Why this mattered: The tokenomics design was anchored to real-world cash flows, not arbitrary APR targets. That made the model investor-ready.

Staking Mechanics

We introduced lock-weighted staking with yield boosting to encourage long-term holding and align token demand with platform usage.

Lock Weighting

| Lock Duration | Multiplier | Behavior Incentivized |

|---|---|---|

| 1 month | 1.0× | Flexible participation |

| 6 months | 1.5× | Medium-term conviction |

| 12+ months | 2.0× | Long-term alignment |

Lock-weighted staking model

Outcome: Staking became a mechanism for long-term alignment (not just emissions farming) while remaining explainable to investors.

Fee Structure & Sustainability

We modeled fees across investor and operator flows to ensure protocol sustainability without excessive value extraction.

Fee Design Goals

- Investor-aligned: Fees remain proportionate to realized yield

- Operator-sustainable: Enough margin to fund maintenance and growth

- Transparent: Simple rules that investors can audit

| Fee Type | Applies To | Design Rationale |

|---|---|---|

| Performance fee | Yield distributions | Aligns revenue with investor success |

| Protocol fee | Platform transactions | Funds operations and product development |

| Staking fee | Reward emissions | Supports long-term sustainability |

The Tokenomics.net Difference

Data-Driven Design

Every mechanism backed by quantitative analysis, not assumptions.

Scenario Stress-Testing

Models tested across market conditions to identify failure modes.

Formula Transparency

Investors can audit the math themselves.

Book a Free Discovery Call

Get a clear plan for incentives, demand capture, and long-term sustainability — and see exactly what working together looks like.