RWA Tokenomics: Designing Token Models for Real Assets

Real-world asset tokenomics requires a fundamentally different approach. Revenue models, compliance layers, and valuation mechanics that work for RWA.

RWA tokenomics is the design of token models that represent real-world assets — real estate, private credit, commodities, and revenue-generating businesses. Unlike DeFi tokenomics driven by emissions and speculation, RWA tokens derive value from real cash flows, operate under securities regulations, and require compliance architectures embedded in the token design from day one.

#Why RWA Tokenomics Is Different

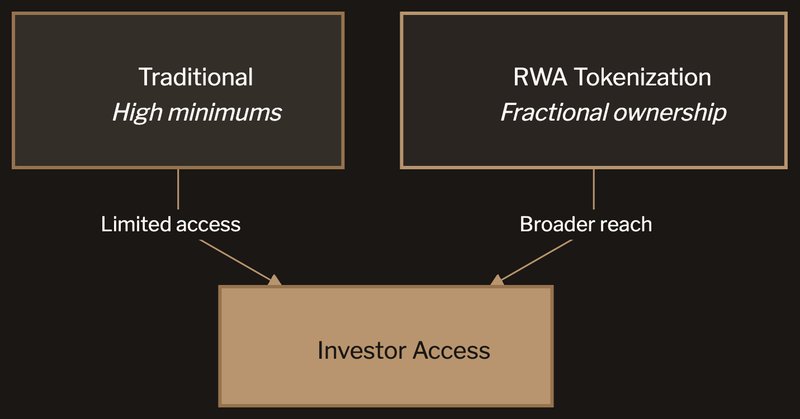

Most DeFi tokenomics start with a token and work backward to find utility. RWA tokenomics start with a real asset and work forward to find the right tokenization structure. This reversal changes everything about the design process.

The scale of this shift is substantial. The tokenized RWA market crossed $30 billion in Q3 2025, led by demand for yield-bearing assets, with institutions like BlackRock, Franklin Templeton, and Fidelity driving issuance volumes (Source: InvestaX). That market has grown 10x since 2022, when total tokenized value stood at $2.9 billion (Source: InvestaX).

"Tokenization can greatly expand the world of investable assets beyond the listed stocks and bonds that dominate markets today." — Larry Fink & Rob Goldstein, CEO & President/COO, BlackRock (World Economic Forum)

But most RWA tokenomics we see are DeFi models awkwardly grafted onto traditional assets. That doesn't work. The three fundamental differences demand a different approach:

Revenue comes from the real world. Your token's value isn't derived from protocol fees or speculative demand. It's backed by rental income, commodity yields, interest payments, or tangible cash flows. Revenue-first design isn't aspirational here — it's structural.

Compliance is the architecture, not a feature. With securities regulations applying to most RWA tokens, your compliance framework determines what the token can do, who can hold it, and how it can be traded. According to Finance Magnates' analysis of RWA tokenisation, token design must map asset economics into enforceable tokenholder rights, with custody, governance, and regulatory positioning essential for institutional adoption (Source: Finance Magnates).

Valuation has a floor. Unlike utility tokens where value is purely market-driven, RWA tokens have a net asset value anchored to the underlying asset. Your tokenomics need to handle the relationship between token price and NAV — premium, discount, and the mechanisms that pull them together.

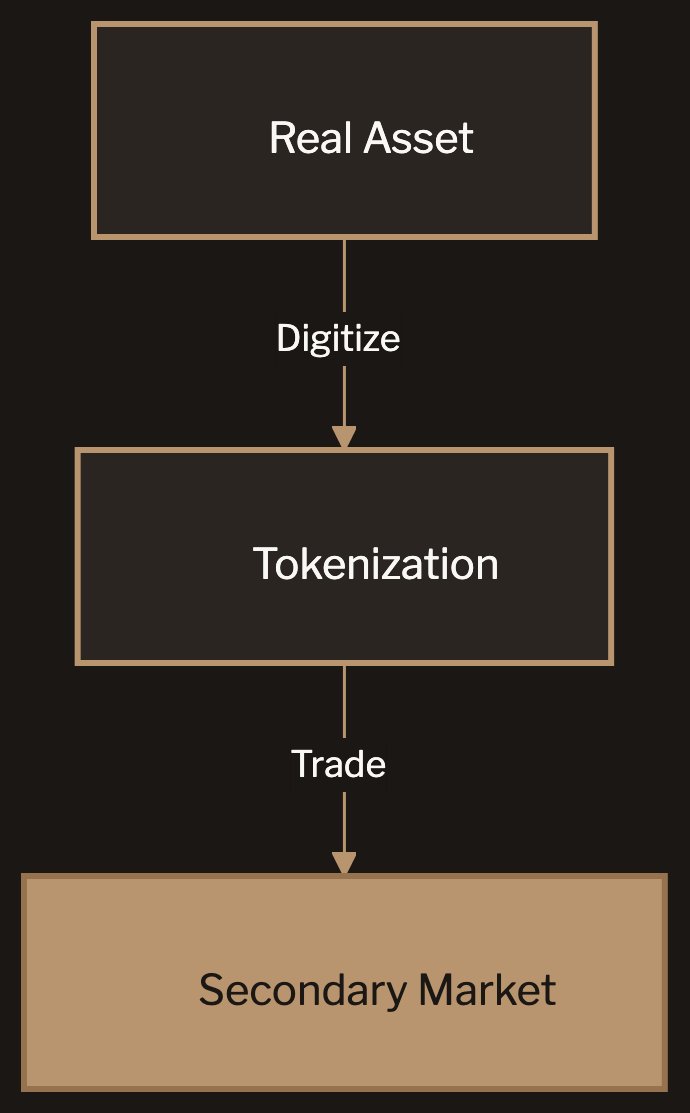

#The RWA Value Chain

Every RWA tokenization follows the same value chain, regardless of asset class. Understanding this chain is prerequisite to designing the tokenomics. We call this the RWA Value Chain Framework.

Real Asset. The underlying property, commodity, financial instrument, or revenue stream. This is where all value originates. RWA tokens work by pairing an on-chain token with a legal claim to an off-chain asset, following a lifecycle from mint to redemption with embedded compliance (Source: Stablecoin Insider).

Tokenization. The legal and technical process of creating digital representations of ownership or rights to the asset. This layer houses your token design, compliance framework, and smart contract architecture. Get this layer wrong and everything downstream breaks.

Secondary Market. Where tokens trade after issuance. This layer handles price discovery, liquidity provision, and the ongoing relationship between token price and asset value. 2026 marks the pivot from experimental pilots to active global markets, focusing on market liquidity, programmable trust, and on-chain DvP settlement (Source: PR Newswire).

#Revenue Model Design

Revenue-first design is our core principle, and it applies even more strongly to RWA tokens. Your revenue model needs to answer three questions: Where does yield come from? How does it flow to holders? What does the protocol keep?

#Yield Sources

For real estate tokens, yield comes from rental income, property appreciation, and refinancing events. For commodity tokens, it's production yield, storage economics, or price appreciation. For debt instruments, it's interest payments. Private credit dominates the current market at approximately $17 billion of the total tokenized value.

The key design decision is whether yield is passed through directly or accumulated in a treasury for periodic distribution. Pass-through is simpler and more transparent. Accumulation gives more flexibility for reinvestment and smoothing, but adds complexity and trust requirements.

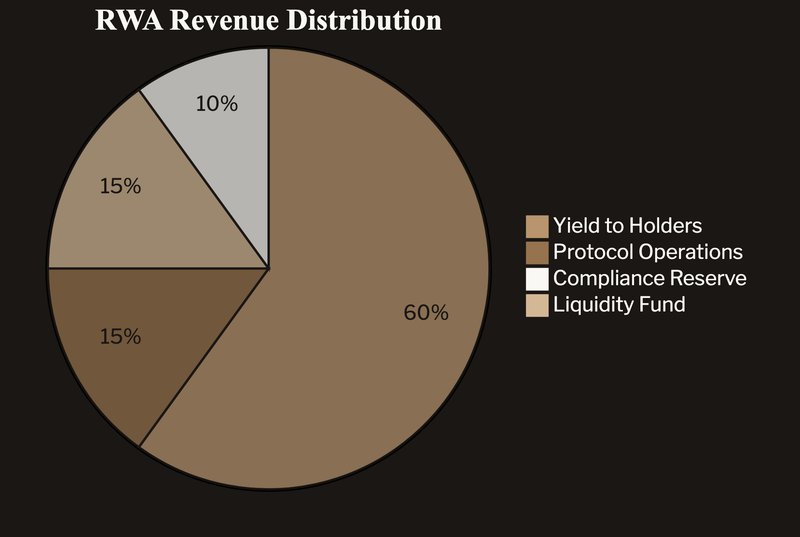

#Revenue Distribution

How protocol revenue splits between stakeholders determines long-term sustainability and token attractiveness.

A sustainable RWA revenue split typically looks like:

- 50-70% to token holders — The primary reason people hold the token. Must be competitive with traditional alternatives.

- 10-20% to protocol operations — Running the platform, maintaining compliance, paying for audits and legal.

- 5-10% to compliance reserve — Regulatory requirements, insurance, legal defense fund.

- 5-15% to liquidity fund — Market making, DEX liquidity, redemption buffer.

The exact split depends on your asset class and competitive landscape. Real estate tokens compete with REITs, so yield pass-through needs to be comparable. Commodity tokens compete with ETFs. Your yield must justify the additional complexity of tokenized ownership.

#Fee Architecture

Beyond yield distribution, your fee model matters. Management fees at 0.5-2% of AUM are standard and familiar to institutional investors. Performance fees of 10-20% above a hurdle rate align incentives between protocol and holders. Keep transaction fees low — high fees kill liquidity, and liquidity is the primary benefit of tokenization. Redemption fees discourage short-term speculation and help manage cash reserves.

#Compliance-First Token Design

For RWA tokens, compliance isn't something you bolt on after mechanism design. It's the foundation that determines which mechanisms are even possible.

#Token Standard Selection

Your choice of token standard determines your compliance capabilities:

ERC-3643 — Purpose-built for compliant security tokens. Built-in identity verification, transfer restrictions, and recovery mechanisms. If you're tokenizing securities in regulated markets, evaluate this standard first.

ERC-1400 — Another security token standard with partition-based management. Good for complex structures with multiple share classes or tranches.

ERC-20 with wrapper contracts — Most flexible but least compliant-by-default. You'll need to build all compliance logic in additional contracts, increasing development cost and audit surface area.

#Transfer Restrictions

RWA tokens almost always need transfer restrictions. Design decisions include whitelist-only transfers, jurisdiction restrictions, holding period requirements, accreditation checks, and maximum holder limits. These restrictions reduce liquidity by definition — your tokenomics model needs to account for this when projecting token value and trading volumes.

#Valuation Mechanics

RWA tokens have a unique challenge: maintaining alignment between the token price on secondary markets and the net asset value of the underlying assets.

#NAV Tracking

Most RWA tokens use one of three NAV-alignment mechanisms:

Redemption rights. Holders can redeem tokens at NAV, creating a hard floor under the price. If tokens trade below NAV, arbitrageurs buy and redeem. Design considerations include redemption frequency, processing time, and minimum amounts.

Periodic rebalancing. The protocol adjusts supply or distributions to align value with NAV. Less immediate but lower operational complexity.

Oracle-based pricing. Trusted price feeds report NAV onchain, allowing smart contracts to enforce price guardrails. Requires reliable oracle infrastructure and introduces oracle risk.

#Monte Carlo Stress Testing

Every NAV-tracking mechanism needs to be validated through Monte Carlo simulations. Run thousands of scenarios across your key variables — asset yield volatility, redemption rates, market liquidity conditions — to understand how your NAV-tracking mechanism performs under stress.

A Monte Carlo analysis might reveal that your redemption mechanism works well at normal redemption rates but breaks down if 15% of holders redeem in the same quarter. That's the kind of insight you need before launch, not after.

#Premium and Discount Management

In practice, RWA tokens often trade at a premium or discount to NAV. Your tokenomics should handle both:

Premium scenario. Token trades above NAV. Options include issuing new tokens backed by additional assets, increasing yield distribution to reduce demand pressure, or letting the market find its own level.

Discount scenario. Token trades below NAV due to thin liquidity or low confidence. Options include protocol buybacks using treasury funds, reduced supply through burns, or increased distributions to attract buyers.

Design these mechanisms before you need them. Reacting to a discount crisis with improvised solutions destroys confidence.

#Structuring for Different Asset Classes

#Real Estate

Real estate RWA tokens represent fractional ownership in a property or portfolio. Key design considerations include rental income distribution cadence, capital event handling, token holder governance rights, and geographic diversification strategy. Our EcoYield case study demonstrates how we structured tokenomics for an RWA project with sustainable yield mechanics and compliant transfer restrictions.

#Commodities

Commodity tokens represent ownership of physical goods or production rights. Storage and insurance costs factor into yield calculations. Delivery mechanisms — physical redemption vs. cash settlement — affect token design. Seasonal production patterns influence revenue timing and distribution schedules.

#Debt Instruments

Tokenized debt has the most straightforward revenue model: interest payments map directly to token yield. Maturity events require clear token lifecycle design. Default risk needs Monte Carlo modeling and transparent communication. Tranching enables different risk-return profiles within the same underlying pool.

#Common RWA Tokenomics Mistakes

Ignoring liquidity realities. The biggest mistake is modeling liquidity like a DeFi token. RWA tokens have restricted transfers, accreditation barriers, and smaller potential holder bases. Your liquidity model needs to reflect this reality, not a permissionless fantasy.

Underestimating compliance costs. Ongoing compliance isn't free. We've seen projects budget 2% for KYC/AML, regulatory reporting, and legal counsel, then discover the real number is 8-12%. Model these costs in your Monte Carlo simulations from the start.

DeFi yield expectations. RWA tokens generate real-world yields of 4-12% annually for most asset classes. If your model requires 30% APY to attract holders, you're designing for speculators, not institutional investors. The advantage of RWA tokens is stability and predictability.

Overlooking the comparison. RWA tokens compete directly with REITs, ETFs, and private equity funds. Your tokenomics need to offer genuine advantages: lower minimums, better liquidity, more transparency, or lower fees. "It's on the blockchain" isn't a competitive advantage by itself.

Skipping the data room. Institutional investors expect institutional-grade documentation for RWA tokens — tokenomics data rooms with Monte Carlo outputs, compliance frameworks, and audited models. The data room checklist covers the full inventory.

#Building Your RWA Token Model

If you're designing tokenomics for a real-world asset project, start with this sequence:

- Define the asset and its cash flows. Everything builds from this. What's the yield? How predictable is it? What's the track record?

- Choose your compliance framework. Token standard, transfer restrictions, investor requirements. This determines your design constraints.

- Design the revenue distribution. How yield flows from the asset to token holders, and what the protocol retains.

- Model NAV tracking mechanisms. How will you maintain alignment between token price and underlying value?

- Run Monte Carlo stress tests. What happens if yields drop 30%? If regulations restrict your market? If liquidity dries up? Run at least 10,000 scenarios.

- Package it in a data room. Every model, assumption, and legal opinion in one place.

Analysts project tokenization could reach $16-30 trillion by 2030, per BCG and ADDX estimates (Source: Mintlayer). The projects that capture that opportunity will be the ones that get the tokenomics right — real revenue, real compliance, real stress testing.

If you're building an RWA project and need your tokenomics to hold up under institutional scrutiny, book a discovery call. We'll assess your asset structure and tell you whether we're the right fit. Sometimes we're not. We'll tell you that too.