ERC-3643: The Standard for Compliant Security Tokens

ERC-3643 is the token standard built for regulated securities. How it works, why it matters, and when your project needs it over ERC-20 or ERC-1400.

ERC-3643 is an Ethereum token standard designed for regulated securities that embeds identity verification and transfer compliance directly into the smart contract. Unlike ERC-20 tokens that anyone can freely transfer, ERC-3643 tokens can only be held and transferred by verified participants — making compliance enforcement automatic and trustless.

#Why ERC-3643 Exists

If you're tokenizing a regulated security, the question isn't whether you need compliance mechanisms — it's whether to build them yourself or use a standard designed for it. Building compliant transfer logic from scratch is expensive, error-prone, and unnecessary when a purpose-built standard exists.

ERC-3643 is an Ethereum-based protocol for creating and managing permissioned tokens that represent real-world value and can only be held and transferred by verified participants (Source: Chainalysis). The standard achieved EIP "Final" status in December 2023, marking it as the first compliant tokenization standard officially recognized by the Ethereum community (Source: Kaleido).

"The future of tokenized finance depends on standardization. ERC-3643 gives the industry a common language for compliant tokenization." — Luc Falempin, CEO of Tokeny & Head of Product Apex Digital, Apex Group (Hedera Blog)

Tokeny Solutions, the company behind ERC-3643, now powers over $32 billion in tokenized assets (Source: Tokeny). DTCC joined the ERC3643 Association in March 2025, adding the standard to its ComposerX platform for digital asset markets (Source: DTCC).

We've advised projects on token standard selection across dozens of engagements. Here's when ERC-3643 is the right choice and how it works under the hood.

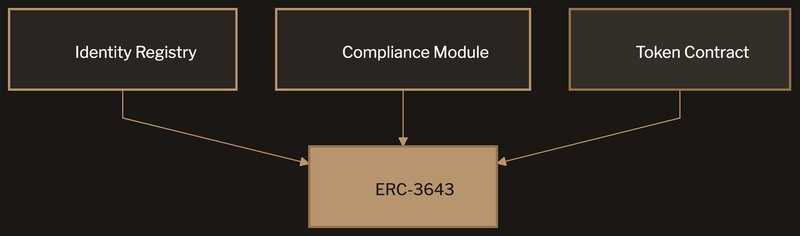

#The ERC-3643 Architecture

The standard's architecture has three core components that work together to enforce compliance at the protocol level. We call this the ERC-3643 Architecture framework.

Identity Registry — An onchain registry that maps wallet addresses to verified identities using ONCHAINID, a self-sovereign identity framework. Each identity carries claims — verified attributes issued by trusted claim issuers. Claims can include accreditation status, jurisdiction, investor type, and any other attribute your compliance framework requires.

Compliance Module — A modular set of rules governing which transfers are permitted. Rules can restrict transfers by country, investor type, holding period, maximum holder count, or any custom condition. Rules are composable — stack the ones you need and leave out the rest. This modularity means your compliance can evolve without redeploying the token contract.

Token Contract — The ERC-20-compatible token that checks both the identity registry and compliance module before executing any transfer. Compatible with standard wallets and exchanges that support ERC-20, but with compliance enforcement built in. This backward compatibility is critical for ecosystem adoption.

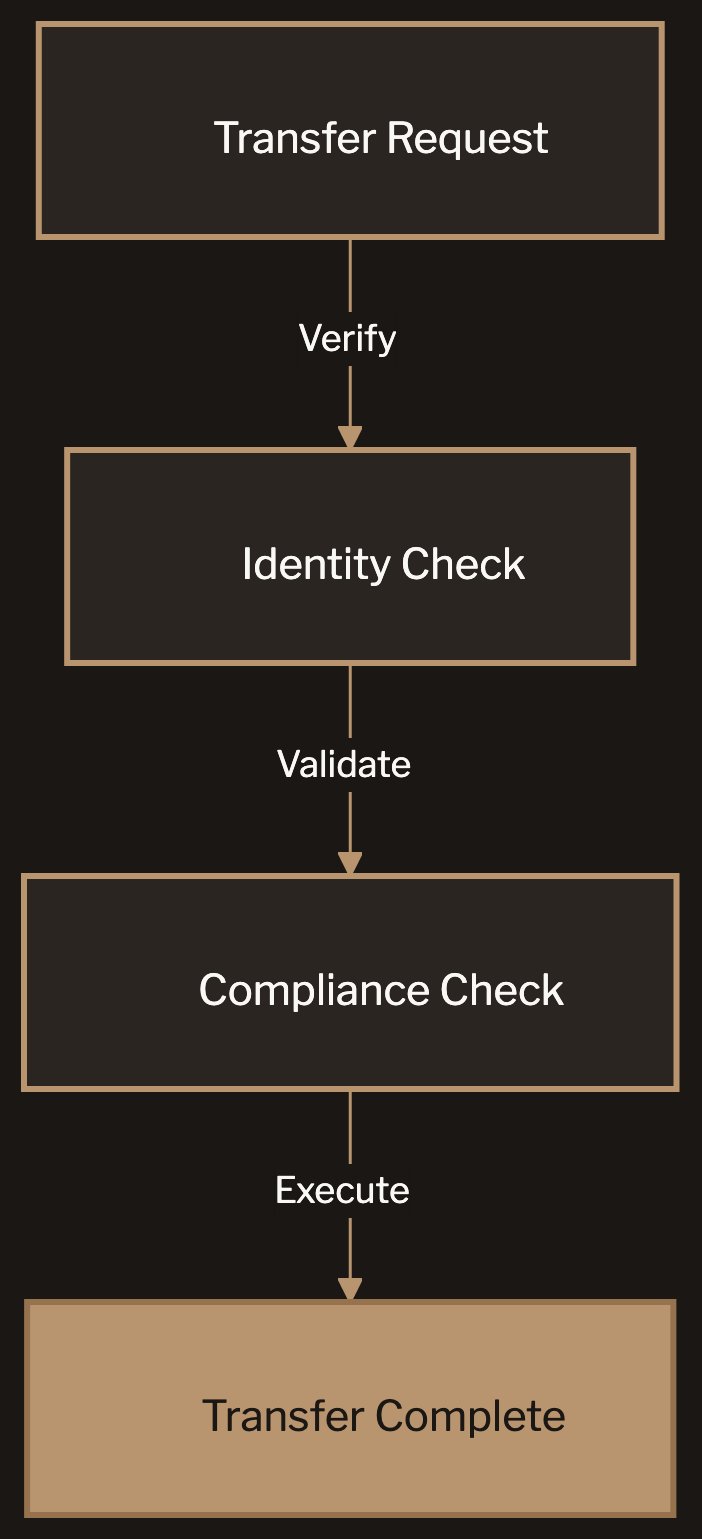

#The 4-Step Transfer Flow

Every token transfer goes through a predictable validation sequence we call the 4-Step Transfer Flow. Understanding this flow matters for your tokenomics because it affects transaction costs, user experience, and system architecture.

Step 1: Transfer request. A holder initiates a transfer to another address. From the user's perspective, this looks like a standard ERC-20 transfer.

Step 2: Identity check. The token contract queries the identity registry. Are both sender and receiver registered? Do they have valid, non-expired identity claims from recognized claim issuers? If either party fails, the transfer reverts.

Step 3: Compliance validation. If identities check out, the compliance module evaluates the transfer against all active rules. Is the receiver in a permitted jurisdiction? Would this transfer exceed a maximum holding threshold? Does the receiver meet accreditation requirements? All rules must pass.

Step 4: Transfer execution. Only if both identity verification and compliance validation pass does the token transfer execute. The balance moves from sender to receiver.

This four-step process adds gas cost compared to a standard ERC-20 transfer. The tradeoff is that compliance is enforced automatically and trustlessly — no manual approval or off-chain whitelists that can fall out of sync.

#When You Need ERC-3643

Not every token needs this level of compliance infrastructure. The standard is purpose-built for specific scenarios:

Tokenized securities. If your token represents equity, debt, or any instrument qualifying as a security under applicable law, you need transfer restrictions. ERC-3643 provides them natively.

Real-world asset tokens. RWA tokenomics frequently require identity verification and transfer restrictions. Real estate tokens, commodity-backed tokens, and revenue-sharing tokens in regulated markets benefit from ERC-3643's compliance framework. Our EcoYield case study shows how standard selection shaped the compliance architecture for an RWA project.

Tokens targeting institutional investors. Institutions expect compliance-by-design. A token transferable to any address without verification is a red flag for investors with fiduciary obligations.

Multi-jurisdictional offerings. The compliance module's rule composability lets you enforce different restrictions for different jurisdictions from a single token contract.

#When You Don't Need ERC-3643

Pure utility tokens. If your token provides access to a service without investment characteristics, ERC-20's simplicity is a better fit. Compliance infrastructure on a utility token creates friction without benefit.

DeFi governance tokens. Governance tokens without revenue rights or investment expectations typically don't need transfer restrictions. ERC-20 gives maximum DeFi composability.

Projects without regulatory clarity. If you haven't gotten a legal opinion on your token's classification, choosing ERC-3643 prematurely locks you into security token infrastructure. Get the analysis first.

#Tokenomics Implications

Choosing ERC-3643 has direct implications for your token model:

Liquidity is structurally lower. Transfer restrictions mean fewer potential holders and counterparties. Your liquidity model needs to account for a restricted market. Plan market-making and liquidity provision accordingly.

Onboarding costs are higher. Every holder needs verified identity claims before receiving tokens. This KYC/AML process adds cost and friction. Factor these into your fee model and user acquisition estimates.

Recovery mechanisms are built in. ERC-3643 supports forced transfers — lost tokens can be recovered and legal compliance actions executed onchain. This is essential for regulated securities but changes the trustless nature of traditional crypto tokens.

Claim issuers are a dependency. Your token's functionality depends on trusted claim issuers maintaining accurate identity claims. If a claim issuer goes offline, token transferability is affected. Plan for redundancy.

Gas costs are higher per transfer. The identity and compliance checks add gas overhead to every transaction. For tokens with high transfer frequency, this compounds. For securities that trade infrequently, it's negligible.

#ERC-3643 vs. ERC-1400

Both are security token standards with different approaches:

ERC-1400 focuses on partition management — dividing tokens into different classes with different rights. More flexible on identity system choice (you bring your own) but less prescriptive about compliance enforcement. Uses offchain-generated keys for trade validation.

ERC-3643 prescribes the identity system (ONCHAINID) and builds compliance into the transfer mechanism. Uses automatic blockchain-based validators instead of offchain keys. Less flexibility, more out-of-the-box compliance.

If you need automated, trustless compliance enforcement with a standardized identity framework, ERC-3643 is the stronger choice. If you need partition management for multiple share classes and want to choose your own identity infrastructure, ERC-1400 may fit better.

#Documentation Requirements

If you're using ERC-3643, your tokenomics data room needs additional documentation:

- Identity provider selection — Which claim issuers you're using and why

- Compliance rule configuration — Which rules are active and the regulatory basis for each

- Transfer restriction rationale — Legal analysis supporting each restriction

- Recovery policy — Under what circumstances forced transfers will be executed

- Upgrade governance — How compliance rules can be modified and who has authority

This documentation goes in the technical specifications and legal compliance sections of your data room checklist. Investors and their legal teams will review it closely. The data room overview covers the full context.

ERC-3643 is infrastructure for regulated tokenized securities. If that's what you're building, the standard eliminates months of custom compliance development. The decision comes down to your token's regulatory classification — get the legal opinion first, and the standard selection follows naturally.

If you're building a compliant security token and need your tokenomics to hold up under institutional scrutiny, book a discovery call. We'll assess your compliance requirements and tell you whether we're the right fit. Sometimes we're not. We'll tell you that too.